Hit enter to search or Esc to close

How can the food and drink system support economic recovery?

Market Report

15 min

12th June 2025

IGD in partnership with Newton: Driving Growth within the Food System

IGD, in partnership with Newton, convened a group of senior finance leaders from across the food and drink sector to answer the pivotal question: how can the food system grow – despite slow economic growth and the turmoil of today’s politics?

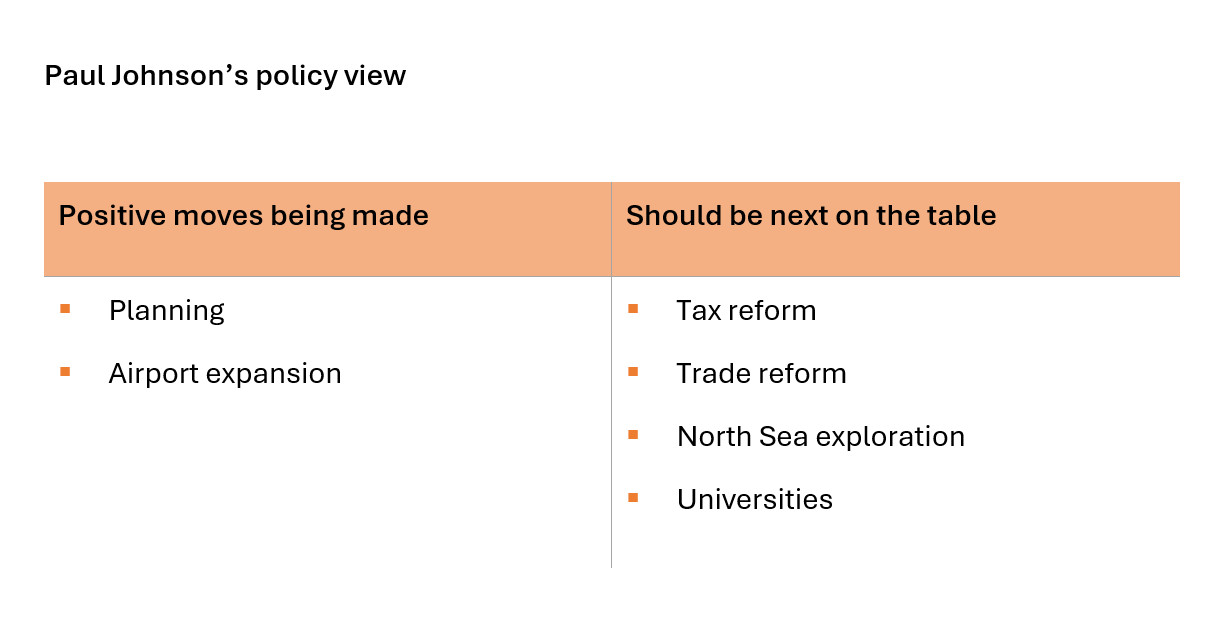

It was an insightful, often challenging, session. Guest speakers included IGD’s Chief Economist James Walton who spoke on growth from a food system viewpoint. Also giving his views was IFS’s Paul Johnson who took a wider view, considering how the government can drive growth across the whole economy.

This article explores the economic and industry data discussed, revealing potential opportunities and pitfalls for food and drink – arguably the UK’s most strategically and socially important sector.

Issues at the forefront of CFO’s minds: Everything is a balance

- Will planning legislation changes have a positive impact on expansion plans? Could environmental concerns derail new facilities getting the go-ahead?

- How will the rise of diet drugs impact eating choices? What adaptations need to be made to packaging, displays, communication and beyond?

- How does the industry attract more AI and automation talent without government incentives?

- Is there more growth to be had in the low and no alcohol market where profit margins are low, but saturation is high?

- How will complex, new packaging regulations work in practice?

- How can the industry reduce waste while increasing production to help grow the economy and self-sufficiency?

- Is it time to increase space on the shelves for luxury foods and at home experiences, as eating out becomes more expensive?

Section 1.

How can the UK government spur on growth?

Tax rises… incoming?

“We’ve been through an extraordinary and lengthy period of poor growth as a country,” says Paul Johnson from IFS. “We’re like boiling frogs that have been in the pot for the last 15 years.”

Over that time, UK GDP per capita has risen about 10%. But if the trend had continued at the same rate as before the financial crisis, it would have hit close to 40%. That means the average person is around £10,000-a-year worse off than they might have been. The result? Flatlining living standards and a squeeze on disposable income.

What of the near future? Will the situation ease? Are we likely to see faster growth over the next few years? The data suggests that’s unlikely, says Paul. The OBR is one the most positive forecasters: even it is only forecasting a 1.7% rise – and that was before the US introduced tariffs.

So, how will the government likely stimulate growth? The country’s tax take is higher than ever and that’s unlikely to change anytime soon due to demographic changes and an increase in defence investment. The government needs to increase its income substantially, and the answer isn’t going to be to borrow more.

Instead, it is likely a combination of cuts to government departments and tax rises for businesses. “There are difficult decisions to be made by the Chancellor ahead of the Spending Review and Autumn budget, especially if she is to stick to her own “ironclad” fiscal rules,” says Paul. “Will she break them, or take sensible long-term, possibly unpopular steps? Growth is the right mission, but it remains elusive, and plans need to be faster and more radical.”

Possible win-wins at the front of mind for CFOs at the event

- Supporting consumers to have moments of luxury when they could be cutting back elsewhere e.g. making space for dinner kits if eating out becomes too expensive

- Alcohol-free beverages that have higher profit margins whilst being better for consumers

- Creating momentum on food waste reduction at a time when margins are more important than ever

Section 2.

How can the food and drink sector spur on its own growth?

The sector is already an economic asset

The food and drink industry in the UK makes a greater economic contribution than financial services, manufacturing or digital and creative.

That contribution is consistent over time, spread across the UK and difficult to move to where the greatest tax breaks may be.

This stability could represent a key part of a balanced and secure economic plan. “Even small gains on that huge base could be significant to the country’s growth,” says IGD’s Chief Economist James Walton.

It may be large, but what is the sector’s growth potential? The Department for Business and Trade’s Invest 2025 green paper identified sectors offering the greatest growth potential due to productivity levels and the historical productivity gains. Food and drink did not make the cut, highlighting the weak productivity performance in the food system over a long period.

But that could all be about the change.

“The food system and the government need urgent growth, and that convergence is an opportunity”

James Walton, Chief Economist IGD

Geopolitics could see food becoming fundamental to the government’s growth agenda

Recent geo-political instability may see the government start to place more value on domestic self-sufficiency. “Global free trade seems increasingly threatened,” says James. “Support is increasing for UK production in areas like steel and weapons. Will the same apply to food?”

Added to that, growth is required economically, as well as practically in order to meet the increasing population. “The food system and the government need urgent growth, and that convergence is an opportunity,” he adds. Defra is now working with businesses and other interested parties in developing its new Food Strategy.

Where are the growth opportunities?

With decisions made by food and drink businesses impacting health, animal welfare and the environment, the sector’s growth agenda is complex and interlinked. As James puts it: “We need to find out how to get maximum yield for minimum field.” He sees that there are a limited number of growth options:

- Grow in domestic markets

- Grow via overseas trade

Import displacement and increased self-sufficiency could safeguard against geo-political turmoil.

But how realistic is that pivot? The UK is about 60% self-sufficient. These levels improved rapidly between the 50s and the 80s due to agricultural innovation and EU membership.

Where do we need to focus to become self-sufficient today? Due to natural factors and production advantages, we have a shortfall of fresh fruit and vegetables and a surplus of dairy.

Poultry, fruit and vegetables, all in demand, are highly imported making them potential focus areas for import displacement.

It is government policy and buyers within a fairly small number of big businesses that will ultimately decide which route we go down. “Historically, the UK government has often seen imports as a way of boosting food security and holding prices down for shoppers,” explains James, “But, if trade is not flowing freely, over reliance on imports becomes a real vulnerability – an Achilles’ heel.”

“Expanding UK production would give better resilience, economic growth and trade benefits – a triple gain”

James Walton, Chief Economist IGD

Levers for growth across the food system

- Bolstering confidence with consistent policy. James believes Defra’s Food Strategy will deliver this if the industry really shapes and backs it, calling it a “once-in-a-career opportunity.”

- Simplifying planning regulation. The government is taking action on this right now and which could, for instance, make increasing poultry production easier.

- Boosting investment to drive innovation and productivity. To see similar rapid gains as the UK has unlocked in the past, we need to be equally innovative and bold. What would give us the same benefits in 2025? Robotics? AI? Biotech? Innovative proteins?

- Developing labour and skills policy to future-proof the workforce. We need access to sufficient labour, with the right skills.

“Expanding UK production would give better resilience, economic growth and trade benefits – a triple gain.” says James. Whatever unexpected events happen in the future, one thing is for sure: now is the time to take action and feed into national strategy at every opportunity – for the sake of companies, communities, and citizens.

At Newton, we also see cross-industry collaboration as a key lever for growth and will continue to convene the industry from the end-to-end of the food chain at future events.

For more insights on any of the data mentioned here or to discuss how to unlock growth within your business, please do get in touch.